Citizens Property Insurance Rate Increase 2024. September 27, 2023 · 2 min read. To revamp — and trim — proposed rate increases.florida insurance.

For personal lines policies that are subject to citizens’ glide path, the florida office of insurance regulation (oir) has approved changes that may result in an increase to the statutory maximum allowable individual rate change cap (“glide path”). Florida homeowners are bracing for another home insurance price hike.

To Revamp — And Trim — Proposed Rate Increases.

Citizens property insurance corporation’s board of governors this week voted to file for a 14.2% average increase for personal lines and a 12.3% spike for commercial policies.

Citizens Property Insurance Is Florida’s Insurer Of Last Resort.

September 27, 2023 · 2 min read.

Last Week, Citizens Added More Than 5,500 New Policies, Totaling 1,322,696 Policies.

Images References :

Source: boltzlegal.com

Source: boltzlegal.com

What You Need To Know About Property Insurance Rate Increases Boltz Legal Insurance and, It’s on target now to have over 1.7 million policies by the end of the year,. To revamp — and trim — proposed rate increases.

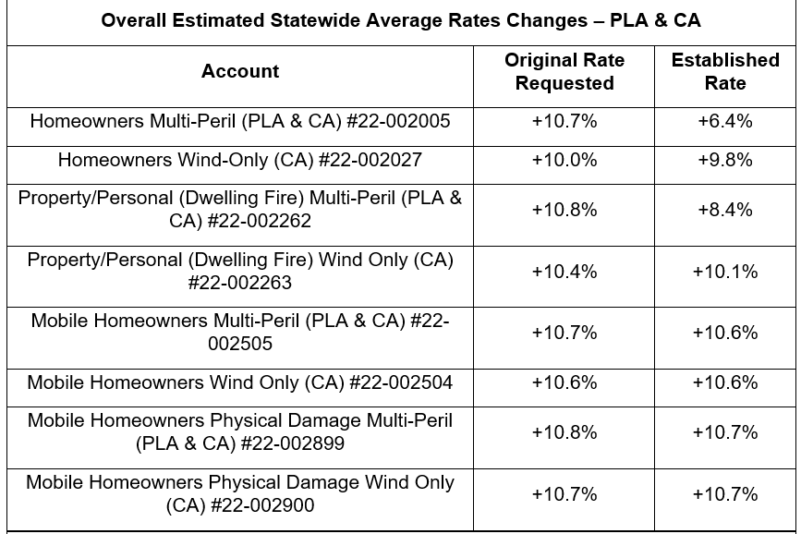

Source: insurancenewsnet.com

Source: insurancenewsnet.com

Florida establishes 2022 rates for Citizens Property Insurance Corp. Insurance News, For personal lines policies that are subject to citizens’ glide path, the florida office of insurance regulation (oir) has approved changes that may result in an increase to the statutory maximum allowable individual rate change cap (“glide path”). Tallahassee — the state’s citizens property insurance corp.

Source: www.valuepenguin.com

Source: www.valuepenguin.com

Citizens Property Insurance Review Low Rates but Limited Offerings From the Government Insurer, Citizens property insurance is florida’s insurer of last resort. For personal lines policies that are subject to citizens’ glide path, the florida office of insurance regulation (oir) has approved changes that may result in an increase to the statutory maximum allowable individual rate change cap (“glide path”).

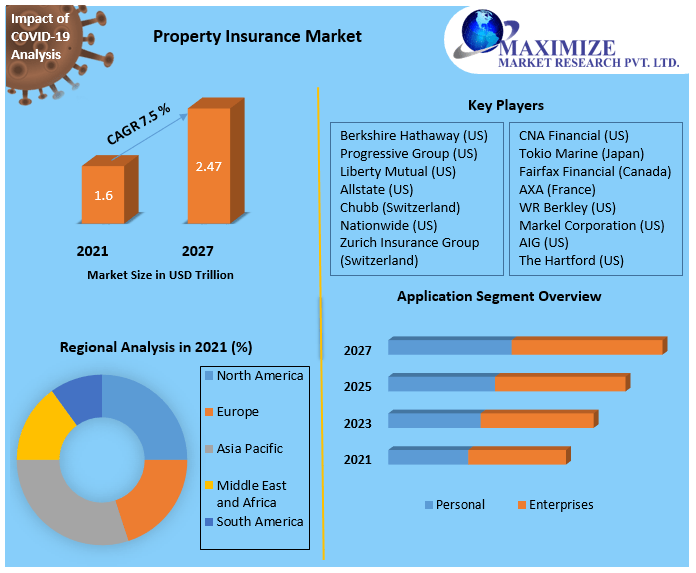

Source: www.maximizemarketresearch.com

Source: www.maximizemarketresearch.com

Property Insurance Market Industry Analysis and Forecast (20212027), Florida homeowners are bracing for another home insurance price hike. It’s on target now to have over 1.7 million policies by the end of the year,.

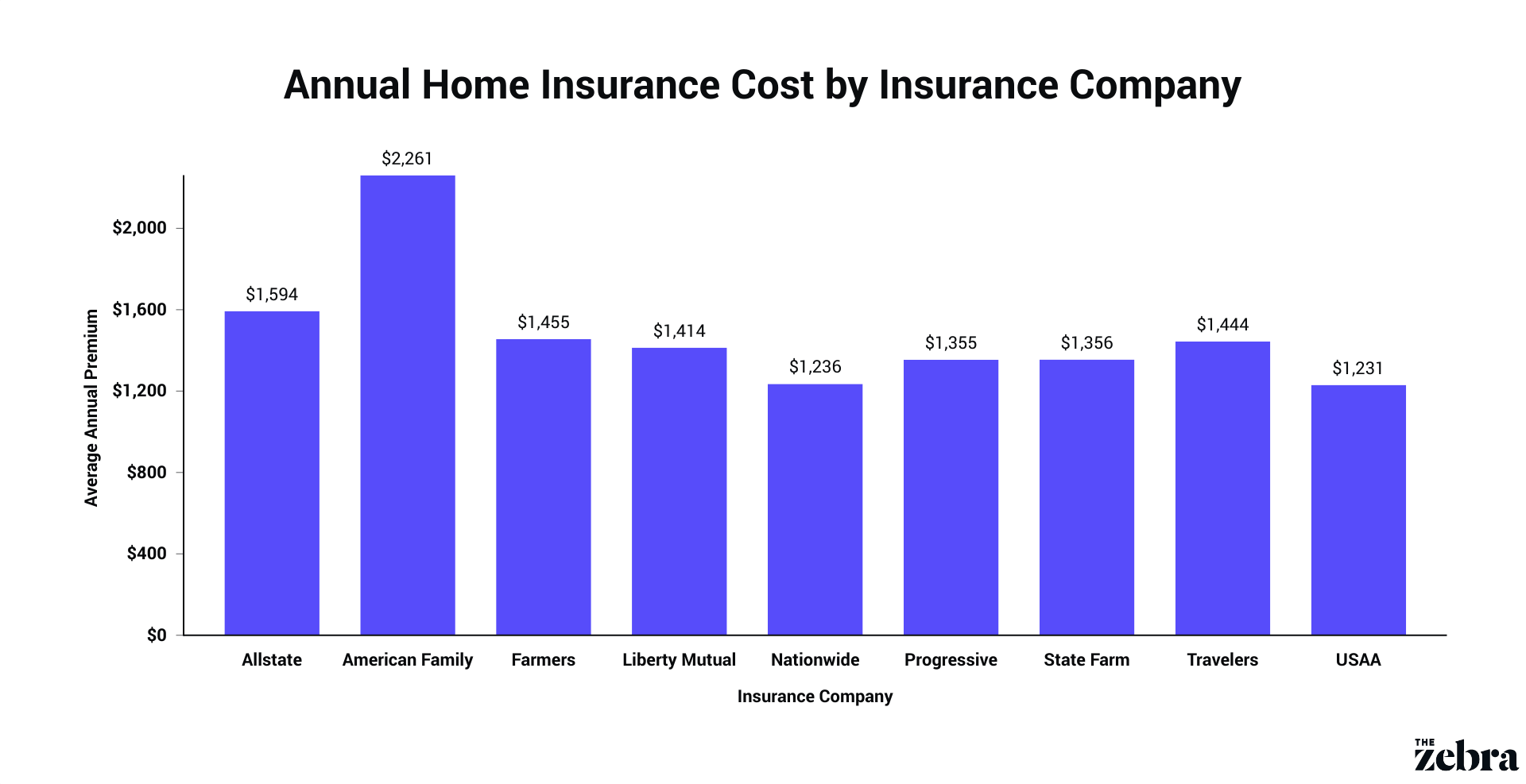

Source: www.thezebra.com

Source: www.thezebra.com

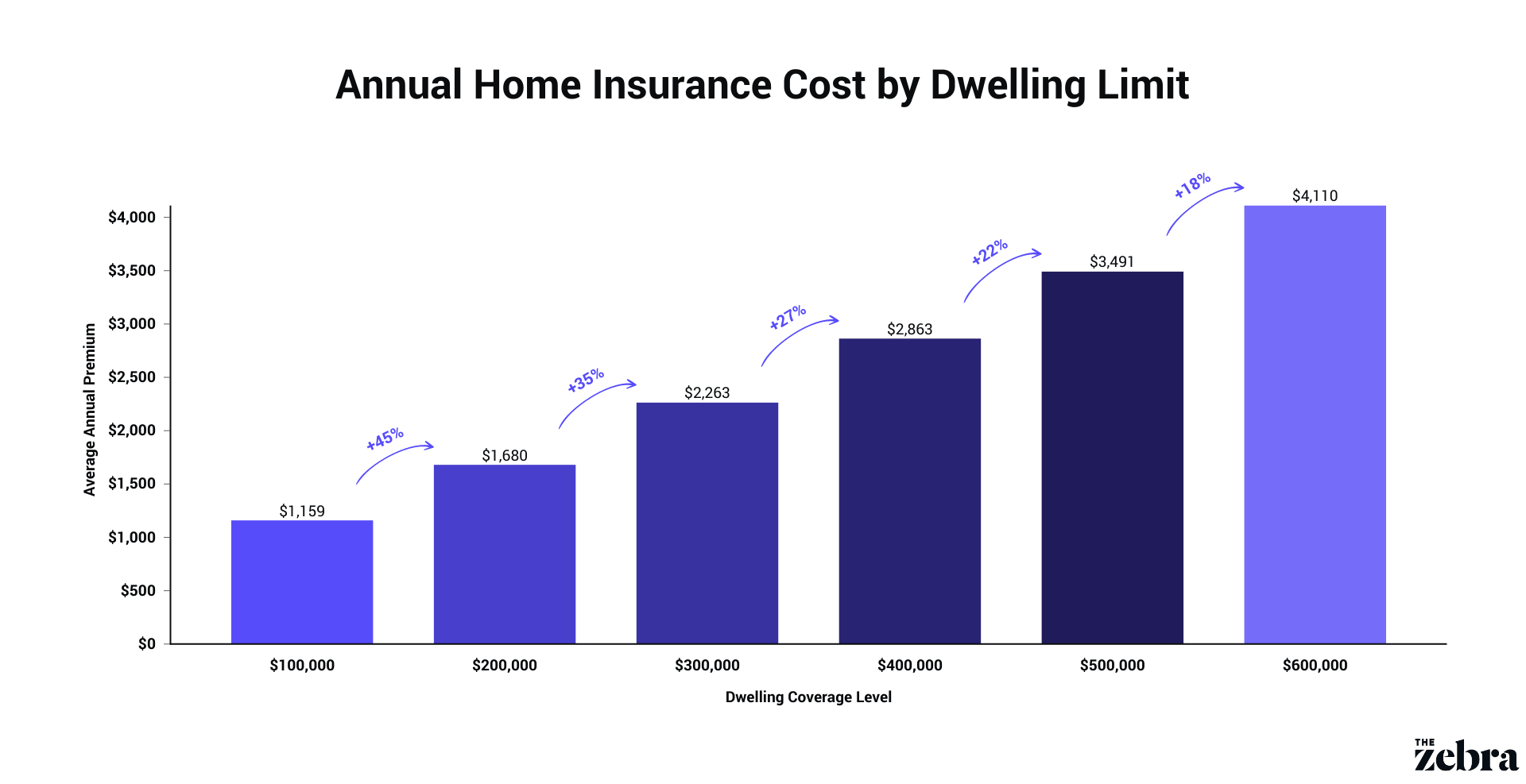

How Much Does Home Insurance Cost on Average? The Zebra, September 27, 2023 · 2 min read. The rate hike plan has.

Source: www.youtube.com

Source: www.youtube.com

Florida Office of Insurance Regulation holds hearing about Citizens Property Insurance rate, To revamp — and trim — proposed rate increases. Tallahassee — the state’s citizens property insurance corp.

Source: clearsurance.com

Source: clearsurance.com

Citizens Property Insurance (Florida) Rates & Ratings, Citizens property insurance corporation’s board of governors this week voted to file for a 14.2% average increase for personal lines and a 12.3% spike for commercial policies. State regulators are telling citizens property insurance to come up with another plan after it proposed a 12% increase.

Source: clearsurance.com

Source: clearsurance.com

Citizens Insurance Company of America Ratings & Discounts, It’s on target now to have over 1.7 million policies by the end of the year,. Tallahassee — the state’s citizens property insurance corp.

Source: www.thezebra.com

Source: www.thezebra.com

How Much Does Home Insurance Cost on Average? The Zebra, Citizens property insurance was asking for a sizable increase as florida’s still unsteady property insurance market continues to wobble. To revamp — and trim — proposed rate increases.

Source: www.mordorintelligence.com

Source: www.mordorintelligence.com

US Homeowners Insurance Market Industry Trends, Share & Overview, Citizens insurance policyholders can expect to see higher premiums when they receive their next renewal letter after the citizens board of governors approved a. Florida homeowners are bracing for another home insurance price hike.

Citizens Insurance Policyholders Can Expect To See Higher Premiums When They Receive Their Next Renewal Letter After The Citizens Board Of Governors Approved A.

Has revised proposed rate increases, with many homeowners.

Tallahassee — The State’s Citizens Property Insurance Corp.

To revamp — and trim — proposed rate increases.